Feel free to share this image on your site.

There's no need to be shy!

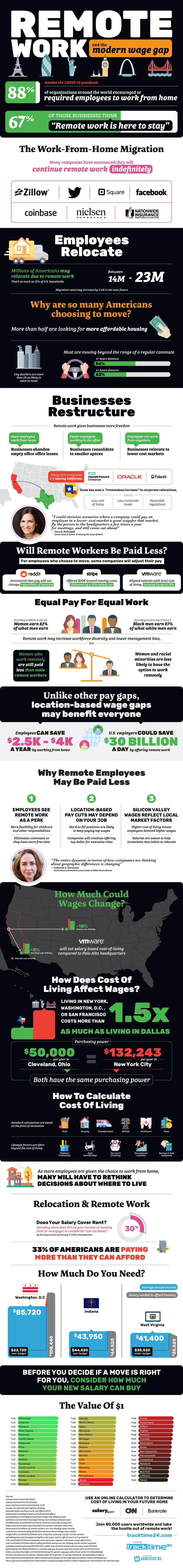

Amidst the COVID-19 pandemic

- 88% of organizations around the world encouraged or required employees to work from home,

- 67% of those businesses think remote work is here to stay.

The Work-From-Home Migration

- Many companies have announced they will continue remote work indefinitely - Zillow, Twitter, Square, Facebook, Coinbase, Nielsen, Nationwide.

Employees Relocate

Between 14 million and 23 million Americans may relocate due to remote work.

- That’s as much as 12% of U.S. households

- Migration rates may increase by 3-4X in the near future

Why are so many Americans choosing to move?

City dwellers are more than 2x as likely to want to move.

More than half are looking for more affordable housing.

Most are moving beyond the range of a regular commute:

- 2+ hours distance: 54%

- 4+ hours distance: 42%

Businesses Restructure

As remote work gives businesses more freedom, many are

- Abandoning leases in favor of work-from-home

- Consolidating offices for essential employees

- Relocating headquarters to lower cost markets

Many tech companies are leaving California: Oracle, HP Enterprise, Palantir.

Texas has seen a “tremendous increase” in corporate relocations, due to:

- Low cost of living

- Low corporate taxes

- Favorable regulations

"I could envision scenarios where a company could pay an employee in a lower-cost market a great wage for that market, fly the person to the headquarters a few times a year for meetings, and still come out ahead" — Terry B. McDougall, Career Coach & Author of Winning The Game Of Work

In 2020, 66% of Americans said they would take a pay cut if it meant they could work remotely.

Will Remote Workers Be Paid Less?

For employees who choose to move, some companies will adjust their pay:

- Reddit: Announced that pay will not change, regardless of location

- Stripe: Offered $20K toward moving costs, followed by a 10% salary cut

- VMware: Aligned salaries with local cost of living, varying by up to 18%

Equal Pay For Equal Work

In the U.S.

- Women earn 82% of what men earn

- Black men earn 87% of what white men earn

Remote work may increase workforce diversity and lower management bias, but

- Women who work remotely are still paid less than male remote workers

- Women and racial minorities are less likely to have the option to remotely

Unlike other pay gaps, location-based wage gaps may benefit everyone

- Employees can save $2,500 to $4,000 a year by working from home

- U.S. employers could save over $30 billion a day by offering remote work

Why Remote Employees May Be Paid Less

Employees see remote work as a perk

- More flexibility for childcare and other responsibilities

- Eliminates commutes so they have more free time

Location-based pay cuts may depend on your job

- Hard-to-fill positions are likely to keep paying top wages

- Companies will continue offering top dollar for executive roles

Silicon Valley wages reflect local market factors

- Higher cost of living mean employees demand higher wages

- Salaries are meant to help incentivize new talent to relocate

“The entire dynamic in terms of how companies are thinking about geographic differences is changing” — Catherine A. Hartmann, North America Rewards Practice Leader at Willis Towers Watson

How Much Could Wages Change?

VMware will cut salary based cost-of-living compared to its’ Palo Alto headquarters

- Moving to Denver: -18%

- Moving to San Diego: -8%

How Does Cost Of Living Affect Wages?

Living in New York, Washington, D.C. or San Francisco costs more than 1.5X as much as living in Dallas.

Remote workers who choose to move may find they’re better off making less.

$50,000 per year in Cleveland, Ohio and $132,243 per year in Manhattan both have the same purchasing power.

How To Calculate Cost Of Living

Standard calculations are based on the price of necessities

- Food

- Housing

- Transportation

- Utilities

- Healthcare

- Taxes

Lifestyle factors are often beyond the cost of living

- Childcare & Education

- Gym memberships

- Pet care & Grooming

- Recreational activities

- Savings & Debt repayment

As more employees are given the choice to work from home, many will have to rethink decisions about where to live.

Relocation & Remote Work

Does Your Salary Cover Rent?

Spending more than 30% of your income on housing (rent or mortgage) is considered “cost burdened” by the Department of Housing & Urban Development

33% of Americans are paying more than they can afford

How Much Do You Need?

Washington, D.C

- Median monthly rent: $2,711

- Salary needed to afford housing: $108,440

- Average annual income: $85,720

- Average earner: $22,720 over budget

Indiana

- Median monthly rent: $1,113

- Salary needed to afford housing: $44,520

- Average annual income: $43,950

- Average earner: $430 over budget

West Virginia

- Median rent: $888

- Average income: $41,400

- Salary needed to afford housing: $35,520

- Average earner: $5880 under budget

Before you decide if a move is right for you, consider how much your new salary can buy.

The Value Of $1

- Alabama - $1.15

- Alaska - $0.95

- Arizona - $1.04

- Arkansas - $1.15

- California - $0.87

- Colorado - $0.97

- Connecticut - $0.92

- Delaware - $1.00

- Florida - $1.00

- Georgia - $1.09

- Hawaii - $0.84

- Idaho - $1.08

- Illinois - $1.01

- Indiana - $1.11

- Iowa - $1.11

- Kansas - $1.10

- Kentucky - $1.14

- Louisiana - $1.11

- Maine - $1.02

- Maryland - $0.91

- Massachusetts - $0.93

- Michigan - $1.07

- Minnesota - $1.03

- Mississippi - $1.16

- Missouri - $1.12

- Montana - $1.06

- Nebraska - $1.10

- Nevada - $1.03

- New Hampshire - $0.94

- New Jersey - $0.88

- New Mexico - $1.07

- New York - $0.87

- North Carolina - $1.10

- North Dakota - $1.09

- Ohio - $1.12

- Oklahoma - $1.12

- Oregon - $1.00

- Pennsylvania - $1.02

- Rhode Island - $1.00

- South Carolina - $1.11

- South Dakota - $1.13

- Tennessee - $1.11

- Texas - $1.03

- Utah - $1.03

- Vermont - $0.98

- Virginia - $0.98

- Washington - $0.95

- West Virginia - $1.14

- Wisconsin - $1.08

- Wyoming - $1.03

Use an online calculator to determine cost-of-living in your future home - Salary.com, Bankrate, CNN

Sources:

- https://www.gartner.com/en/newsroom/press-releases/2020-03-19-gartner-hr-survey-reveals-88--of-organizations-have-e

- https://smallbiztrends.com/2020/06/work-from-home-permanently-survey.html

- https://www.entrepreneur.com/article/354872

- https://thenewstack.io/millions-of-remote-workers-are-now-thinking-about-moving/

- https://www.cnbc.com/2020/07/13/tech-companies-curb-real-estate-expenses-end-leases-merge-offices.html

- https://arstechnica.com/tech-policy/2020/12/oracle-joins-silicon-valleys-texas-exodus/

- https://www.bizjournals.com/austin/news/2020/09/25/corporate-relocation-texas.html

- https://www.shrm.org/resourcesandtools/hr-topics/talent-acquisition/pages/remote-workers-living-lower-cost-locations-be-paid-less.aspx

- https://insights.dice.com/2020/09/15/these-tech-companies-want-pay-cuts-for-remote-workers/

- https://www.cnbc.com/2020/11/05/how-silicon-valley-facebook-salary-cuts-are-shaping-remote-worker-pay.html

- https://www.aauw.org/resources/research/simple-truth/

- https://www.shrm.org/resourcesandtools/hr-topics/compensation/pages/racial-wage-gaps-persistence-poses-challenge.aspx

- https://www.forbes.com/sites/laurelfarrer/2019/04/02/closing-the-gender-pay-gap-with-virtual-work/?sh=2849a36946bd

- https://www.fastcompany.com/90484420/theres-a-massive-pay-gap-between-men-and-women-who-work-from-home

- https://netbasequid.com/blog/remote-work-abandoned-offices/

- https://www.patriotsoftware.com/blog/accounting/average-cost-living-by-state/

- https://www.usatoday.com/story/money/2019/05/25/us-dollar-how-much-its-worth-value-in-every-state/39501091/

- https://www.salary.com/research/cost-of-living

- https://money.cnn.com/calculator/pf/cost-of-living/

- https://www.gobankingrates.com/money/economy/the-salary-you-need-to-afford-rent-in-every-state/#2

- https://www.businessinsider.com/how-much-rent-afford-2017-6

- https://www.salary.com/research/cost-of-living

- https://www.bankrate.com/calculators/savings/moving-cost-of-living-calculator.aspx

- https://money.cnn.com/calculator/pf/cost-of-living/

![Remote Work and the Modern Wage Gap [Infographic]](/static/image?src=https%3A%2F%2Fcdnblog.unrubble.com%2Fpayload-unrubble-images%2F10c46abc-a4c0-4f05-99f4-cfd77765bc24_large.jpg&width=1440&height=540&fit=cover&position=center&quality=65&compressionLevel=9&loop=0&delay=100&crop=null&contentType=image%2Fwebp)